股票软件买卖点怎么显示出来的

Title: Understanding MACD Indicator in Stock Trading Software

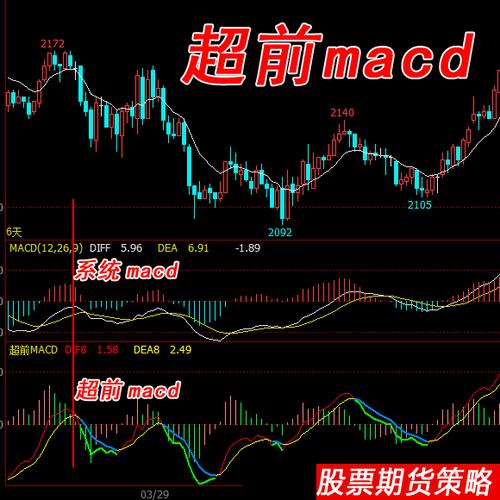

In stock trading, the Moving Average Convergence Divergence (MACD) indicator is a powerful tool utilized by traders to identify potential trend reversals, momentum shifts, and to generate buy or sell signals. When integrated into stock trading software, MACD can provide valuable insights into market trends and help traders make informed decisions. Let's delve deeper into understanding MACD and its significance within stock trading software:

What is MACD?

MACD is a trendfollowing momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of three main components:

1.

MACD Line (the Fast Line):

This is the difference between two exponential moving averages (EMAs), typically the 12day EMA and the 26day EMA.2.

Signal Line (the Slow Line):

This is a 9day EMA of the MACD line.3.

Histogram:

This represents the difference between the MACD line and the signal line. It provides visual cues regarding the strength and direction of the trend.Interpreting MACD in Stock Trading Software:

1. Crossovers:

Bullish Signal:

When the MACD line crosses above the signal line, it indicates a potential buying opportunity as it suggests upward momentum.

Bearish Signal:

Conversely, when the MACD line crosses below the signal line, it suggests a potential selling opportunity as it indicates downward momentum. 2. Divergence:

Divergence occurs when the price of the security moves in the opposite direction of the MACD indicator. It can signal a potential trend reversal.

3. Histogram:

Positive Histogram: Indicates that the MACD line is above the signal line, suggesting bullish momentum.

Negative Histogram: Indicates that the MACD line is below the signal line, suggesting bearish momentum.

4. Zero Line:

When the MACD line crosses above the zero line, it suggests bullish momentum.

When the MACD line crosses below the zero line, it suggests bearish momentum.

Tips for Using MACD in Stock Trading Software:

1.

Confirmation:

Utilize other technical indicators or fundamental analysis to confirm MACD signals before making trading decisions.2.

Timeframe:

Adjust the settings of the MACD indicator based on the timeframe of your trading strategy. Shorter timeframes may require more sensitive settings, while longer timeframes may benefit from broader settings.3.

Risk Management:

Implement stoploss orders to mitigate potential losses, especially when relying on MACD signals for trading decisions.4.

Practice:

Familiarize yourself with MACD through backtesting and paper trading before implementing it in live trading.Conclusion:

Incorporating the MACD indicator into stock trading software can enhance traders' ability to identify trends, gauge momentum, and make timely trading decisions. However, it's essential to understand its interpretation, limitations, and the need for confirmation from other sources. By mastering the MACD indicator within stock trading software, traders can potentially improve their overall trading performance and achieve their financial goals.

股市动态

MORE>-

火灾赔偿标准一览表

火灾保险赔偿标准火灾保险是一种重要的财产保险形式,旨在保护被保险人免...

-

深度解析航天电子的投资价值与未来潜力

对于许多投资者来说,选择正确的股票进行投资不仅是艺术,更是科学,在众...

-

深度解析豫光金铅,行业龙头,黄金矿业的投资潜力与风险探析

一、公司概述:豫光金铅,全称为河南豫光金铅股份有限公司,作为国内领先...

-

深度解析与投资攻略,三丰智能——探索智能化转型的科技巨头

公司简介三丰智能,一家专注于智能制造领域的高新技术企业,以其卓越的自...

-

深度解析东方国信,一只潜力与挑战并存的股市明珠

在风云变幻的股票市场中,东方国信无疑是一颗熠熠生辉的明星,以其稳健的...

- 搜索

- 最近发表

-

- 深入了解股票分析系统的功能模块,投资者的智能助手

- 探索688077,解锁科技新纪元的钥匙

- 综合保险查询,全面了解您的保障

- 东莞疫情新动态,新增1例无症状感染者,市民需保持警惕并加强防护

- 股票在线诊断软件,投资者的智能助手

- 探索铁路股,投资的铁轨与机遇

- 宁波联合(600051)深入解析与投资价值评估

- 同花顺个股分析网,投资者的智能助手

- 深入了解600705,最新动态与投资洞察

- 深入解析同花顺,如何找到并利用个股分析功能

- 辽宁疫情新动态,昨日新增7例本土无症状感染者深度解析

- 2021年端午节,传统与现代的交融

- 探索太平洋A股,投资海洋中的宝藏

- 药石转债,投资新机遇与风险分析

- 股票分析师的工作内容有哪些

- 大晟文化股票诊断,深入分析与投资策略

- 数字密码,解析688209背后的神秘故事

- 辽宁职校封闭管理下的病毒破防,疫情应对与心理调适指南

- 红太阳(000525)探索中国农药行业的领军企业

- 深入解析,股票诊断分析的艺术与科学

- 标签列表

-

- 兴业银行理财月月得益赎回规定 (4)

- 英伟达市值涨了多少倍 (4)

- 博时月月享基金安全吗 (4)

- 港股恒指遭遇重挫跌46% (5)

- 港股恒指怎么交易需要多少资金 (4)

- 主力资金净流入排行榜 (5)

- 股票财经方面有哪些 (13)

- 财经股票基础知识 (6)

- 最好的股票财经网 (8)

- 财经与股票 (10)

- 财经讲股票的栏目 (8)

- 谈论股票的财经频道 (7)

- 财经a股 (5)

- 财经类股票 (13)

- 股票初学者相关财经知识 (6)

- 财经诊股 (5)

- 财经类股票网站 (5)

- 财经股票入门基础知识 (4)

- 股票财经推荐 (5)

- 港股午评:恒指跌3.87%失守24000点 (4)

- 永赢基金行情 (4)

- 股票财经 (6)

- 财经股票怎么玩赚钱 (5)

- 财经股市大家谈 (5)

- 港股恒指今日收盘走势 (4)